So, we urge you to input all the ATM funds received to fund the gambling sessions as evidence for your gambling records. Keep in mind that the IRS kicks against the player’s reward card as it is most times an ingenuine way to prove gambling loses because other gamblers have used the card. The IRS has issued instructions that “lumping” is unacceptable. “Lumping” is the practice of reporting one net win figure and no losses, or reporting nothing if your net from gambling is a loss. You must report the total of your winning sessions separately from.

By Sally P. Schreiber, J.D.

Notice 2015-21 contains a proposed revenue procedure that would permit gamblers engaging in electronically tracked slot machine play an optional safe harbor method to determine a wagering gain or loss from their slot machine play based on day-long play sessions.

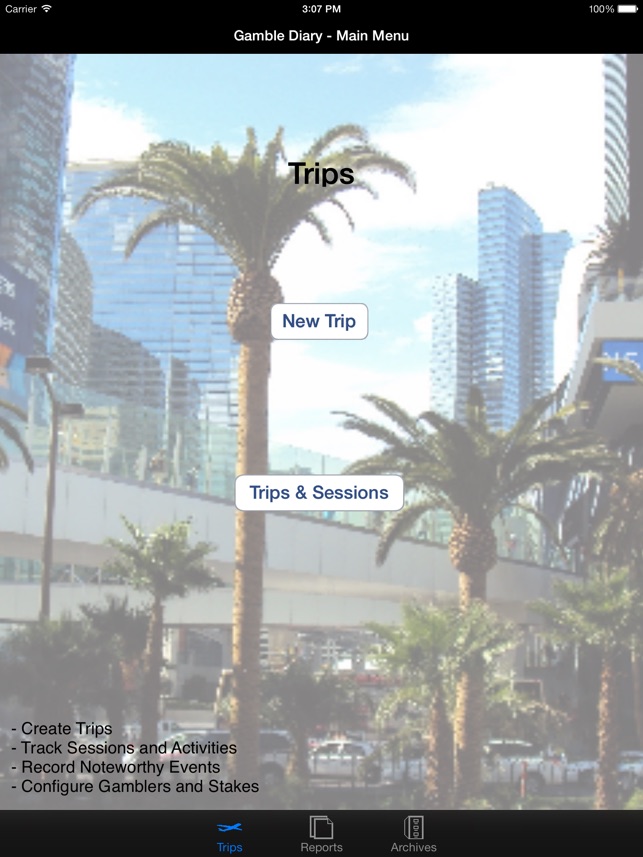

Reporting Gambling Sessions Rules

Reporting Gambling Sessions

Under the safe-harbor, a taxpayer would recognize a wagering gain if, at the end of a single session of play, the taxpayer’s total gains exceeded his or her losses and would recognize a loss if, at the end the session, the total amount of wagers exceeds the amount of payouts. A session would be treated as beginning when a gambler places the first wager on a particular type of game and ending when the same gambler completes his or her last wager on the same type of game before the end of the same calendar day, i.e., beginning on or after 12:00 a.m. and ending at 11:59 p.m.

A gambler using the safe harbor would be required to use the same session of play if he or she stops and resumes the same game in the same establishment during the same calendar day. Also, gamblers cannot offset gains and losses from separate sessions. Once a gambler goes to another gaming establishment, a new session would begin, even if it is on the same calendar day.

Under current IRS rules (Chief Counsel Advice Memorandum AM 2008-011), gamblers are allowed to calculate gambling gains and losses when they cash out of a single gambling session—in the words of the memo, “at the end of slot machine play.” However, determining what constitutes a single session has been difficult, especially with the advent of electronically tracked slot machines, which have led to less redemption of tokens by players.

The safe harbor will not be available until it is published as a final revenue procedure, after which it would apply to tax years ending on or after that date. A provision permitting taxpayers to claim this treatment on their tax returns by providing a note that the return is filed using these procedures will not apply until tax years beginning on or after Jan. 1, 2016.

Before it issues the final rules, the IRS is asking for comments. Specifically, taxpayers should comment on:

- Alternative definitions for the term “slot machine”;

- Whether an interruption in play should result in more than a single session;

- Whether a session should be based on a period other than a calendar day;

- Whether the definition of a single session should be determined by other factors;

- Whether the safe harbor should include merchandise and bonus reward payouts;

- Whether the issue should be part of the IRS’s Industry Issue Resolution program;

- Whether a safe-harbor method should be developed for other forms of gambling; and

- Whether the proposed safe harbor poses problems in administration for stakeholders.

—Sally P. Schreiber is a JofA senior editor.